The OneCause Advantage: How Integrated Payments Impact Your Nonprofit Fundraising Software

How your nonprofit processes donations and other transactions directly impacts your success and day-to-day operations. Without integrated payments, organizations face real and unnecessary challenges. But with the right solution, you can simplify operations, build donor trust, and create a seamless giving experience that inspires generosity.

Let’s explore why integrated payments matter, the benefits they unlock for your mission. We’ll also take a closer look at OneCause Payments™ and how it delivers a smarter, more efficient way to power your fundraising.

What Is an Integrated Payments Solution?

Every donation – from events, online giving campaigns, peer-to-peer campaigns, and text-to-give – requires payment processing. In each case, these payments are either processed through an integrated payments solution or through a separate, third-party payment process.

Here are just a few of the challenges in processing payments outside your fundraising software:

- More time is spent on the manual work required by you and your staff.

- More friction is added to the giving experience, resulting in fewer donations.

- The reconciliation process becomes increasingly more difficult.

- There are significantly more opportunities for human error.

- Extra (and unnecessary) costs may be incurred by your nonprofit.

On the other hand, fundraising software with integrated payments centralizes these processes, delivering efficiencies and new value across your organization.

Why Your Nonprofit Should Use Integrated Payments

Nonprofits today face growing pressure to make every donor interaction simple, secure, and cost-effective. Integrated payments help you rise to that challenge, removing barriers for donors, easing staff workload, and ensuring more dollars go directly to your mission.

Here are a few of the biggest advantages to integrated payments:

- Streamline the Donor Experience: Donors expect the same convenience they enjoy in everyday purchases. Integrated payments offer a one-step checkout for credit cards, popular digital wallets (Apple Pay, Google Pay, PayPal, and Venmo), electronic checks (also known as ACH), and transactions made through Donor-Advised Funds (DAFs). Streamlining this experience converts more donors and encourages them to give, give more, and give more frequently.

- Simplify Reconciliation: Reconciling payment data has often required more time and effort than necessary. With an integrated payments solution, you can access bank deposit information within your nonprofit fundraising software. This frees staff to focus on mission-critical activities instead of wasting hours comparing spreadsheets.

- Enjoy Cost-Effective Processing: While third-party processors (e.g., PayPal) often hit organizations with higher transaction rates, integrated payments can deliver more competitive rates. Some even allow donors to cover processing fees themselves, so more of every dollar goes directly to programming.

- Enhance Security and Trust: Donors want to know their contributions are safe. Built-in, PCI-compliant payment engines reduce risk and reassure donors that their transactions are protected. By offering real-time fraud protection and the security expected by both nonprofits and donors alike, integrated payments solutions can help reduce chargebacks and defend against privacy attacks.

- Support Recurring Giving: Recurring revenue is a cornerstone of any growing nonprofit. When researching integrated payment solutions, be sure to prioritize a platform that supports monthly or weekly giving, enables automated billing, and provides donors with a portal to manage their own recurring giving.

While more providers are developing fundraising software with integrated payments, it’s important for nonprofits to take a close look at what is actually offered. Saving time with simplified reconciliation, improving your donors’ giving experience, and boosting your fundraising revenue comes from choosing the right fundraising software.

The OneCause Advantage: OneCause Payments™

OneCause Payments is the integrated payments solution embedded within the OneCause Fundraising Platform. Not only is it designed to streamline payments and reconciliation for your organization, but it also enhances the giving experience for your donors.

It’s not just about processing payments. It’s about providing an innovative approach to integrated, seamless, and secure payments.

A Single Processor for All Nonprofit Payments

Since OneCause Payments is built directly into the OneCause Fundraising Platform, it serves as the single payment processor for every one of your online, event, auction, peer-to-peer, and Text2Give® transactions. Not only does it provide your executive, development, and financial leadership a single view into all-things payments, it offers some of the industry’s most competitive credit card rates, starting at just 2.0%.

Seamless Giving Experience

With OneCause Payments, your supporters can contribute using their preferred methods – whether it’s by credit card, digital wallet (such as Apple Pay, Google Pay, PayPal, Venmo), ACH transfer, or Donor-Advised Funds (DAFs) via DAFpay. OneCause Payments not only ensures convenience, it also helps you raise more by inviting supporters to give in the way that’s most convenient for them.

Build Donor Trust with Secure Giving

OneCause Payments equips your nonprofit with dependable, protected payment processing that reduces the risk of fraud and chargebacks. By using advanced machine learning, it identifies fraudulent transactions before these payments can be processed.

Your donors can support your mission and give with absolute peace of mind. With OneCause Payments, each transaction is protected with robust security measures for safe and confident giving.

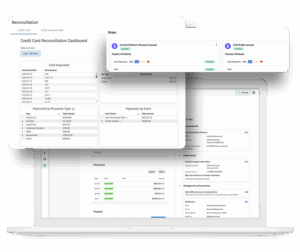

Save Hours with Streamlined Reconciliation

Forget juggling spreadsheets, manual tallies, or piecing together multiple financial summaries. With OneCause Payments, you can instantly see who’s given, how much, and through which channel – all in one place.

And say goodbye to the headaches often associated with reconciliation! With timely payout schedules, clear reporting for all payments and deposits, and the ability to manage recurring giving, chargebacks, and failed payments, your bookkeeping becomes a breeze.

Work with Trusted Leaders in Payment Processing

OneCause Payments has partnered with some of the top leaders in the payment processing industry, such as Stripe® and Deluxe Payments®/First American Payment Systems®.

When organizations open a merchant account with Stripe through OneCause Payments, they enjoy all the benefits of a secure, reliable, and PCI-compliant payment platform that is trusted by millions.

What OneCause Payments Means for Your Nonprofit

Integrated payments aren’t just a feature – they’re a fundraising advantage. By eliminating friction for donors, simplifying reconciliation for staff, and protecting every transaction with built-in security, the right payment solution will help your nonprofit focus more time and energy on your mission.

With OneCause Payments, you get more than just processing power! You gain an experienced and trusted partner dedicated to elevating every aspect of your fundraising. Reach out today and let us know how we can help you reach more and raise more for your mission.